The container shipping segment ticked pasted a significant milestone recently according to industry analysts Alphaliner. It comes as the sector continues to grow and they expect the era of the large ships will expand as carriers look for more economies of scale as they balance against the emerging emissions regulations.

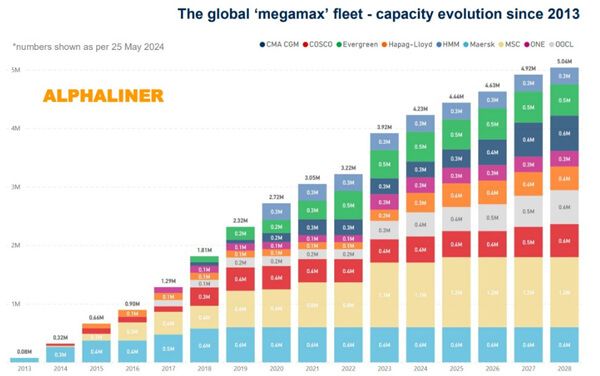

The report highlights that the largest category of containerships, the capacity of 23,000 and 24,000 TEU, which Alphaliner has named “megamax” topped a total capacity of 4 million TEU last month and now stands at 4.01 million TEU with more growth expected as more newbuilds deliver and the next wave of shipbuilding orders is placed.

The report calculates that megamax vessels now account for the vast majority of the total capacity on the routes between Asia and Europe. They have replaced the neo-Panamax vessels as operators turned to economies of scale. Recently, Hapag-Lloyd, MSC Mediterranean Shipping Company, OOCL, and ONE have all introduced their mega ships. They followed the example set by HMM, Evergreen, and CMA CGM that pushed the limit beyond the 18,000 to 20,000 TEU threshold.

Alphaliner says this largest segment began to emerge in 2013 when Maersk launched the Maersk McKinney Moller with a capacity of 18,340 TEU. Interestingly, Maersk however has chosen a different strategy and has not continued the capacity growth, instead ordering its new dual-fuel methanol vessels at a similar capacity.

The megamax segment reached 1 million TEU in April 2017 reports Alphaliner. It reached 2 million TEU in July 2019 and 3 million in October 2021. They foresee the 5 million TEU level but project it will not be till mid-2028 as the pace of megamax orders has slowed. Currently, they calculate there are a total of 186 vessels in the range of 23,000 to 24,000 TEU with 43 more vessels with a total of 1.25 million TEU capacity on order.

While the megamax category has shot up, Alphaliner highlights that only CMA CGM and Hapag-Lloyd also adopted LNG. Only 15 of the ships so far use LNG, while most of the vessels are conventionally fueled.

The displaced neo-Panamax vessels have moved to other routes. The U.S. East Coast ports for example highlighted the arrival of larger vessels as well as second-tier ports, and the entry of bigger vessels into new markets such as Africa. Alphaliner says it expects some of the megamax vessels will be deployed on the routes from Asia to the U.S. East Coast as carriers look for further economies of scale on the longest distance routes. Other routes such as the trans-Pacific are still better suited, they believe, to the neo-Panamax and smaller vessels.

Carriers have also shifted their investments into the smaller classes. Investments have focused on ships in the 5,000 TEU and above categories. There has been an emphasis on feeders for the hub and spokes approach and the growth in transshipments.

The surge in the megamax category mirrors the overall growth in the segment. Alphaliner reports total container capacity stands at just under 7 million TEU with a total of nearly 7,000 vessels. MSC has pulled way out in front at over 5.8 million TEU versus Maersk which remains at 4.3 million TEU. CMA CGM stands poised unless there are changes in the orderbook to leap into second place when it completes delivery of more than 1 million TEU of capacity. It currently has 3.7 million meaning it is just 600,000 behind Maersk.

Analysts have begun to speculate that the sector is getting ready for yet another wave of newbuild orders following the records set in 2020-2021.

We use cookies to improve your experience. By continuing to use our site, you accept our Cookies, Privacy Policy,Terms and Conditions. Close X